Are Carbon Credit Exchanges Still Working?

Carbon Credit Exchanges

Carbon credit exchanges are a key tool for businesses, individuals and governments to reduce greenhouse gas emissions. These markets facilitate trading of emissions and can be classified into either a voluntary or compliance market. They are characterized by low liquidity, lack of data and limited risk-management services. The market is expected to reach a size of around $2.4 trillion by 2027.

One of the key issues with carbon credit exchange is that the market is fragmented. This results in thin liquidity, a lack of price transparency and potential for money laundering. While the CFTC has some anti-fraud authority, it has no statutory authority over the cash and futures markets. This means that the CFTC can only enforce anti-manipulation practices on the carbon credit markets.

However, there is some good news. A new global carbon exchange is set to launch in Singapore by the end of the year. This will facilitate the exchange of large amounts of carbon credits. The exchange will also use a digital process to verify projects, which could help improve the credibility of corporate offsets. Several large financial firms and trading houses have already invested in the exchange.

Are Carbon Credit Exchanges Still Working?

The CFTC has begun to conduct general fact-finding and will continue to review the carbon credit markets. In addition, the Senate has written to the CFTC asking the agency to investigate whether the voluntary carbon offsets markets are a reliable way to reduce greenhouse gas emissions. These senators’ requests go beyond the CFTC’s statutory authority.

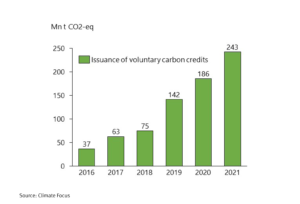

The multi-stakeholder initiative is funded by philanthropy and governments and aims to ensure the voluntary carbon markets operate for the long term. These voluntary markets enable companies to buy or sell carbon credits outside of the regulatory environment. This has become increasingly popular with both businesses and consumers.

The voluntary market is growing, and some companies are setting ambitious goals to become “net zero” emitters. However, some projects have not delivered on their promises. As a result, many are considering investing in carbon credit equities, which can offer investors an opportunity to participate in the global carbon market.

If you are a business or investor, it is a good idea to consider investing in carbon credits. While the market is gaining popularity, it can still be a little tricky to figure out how to invest in it. The market is dominated by institutional investors and multinational corporations. Therefore, it is important to identify the right partners to develop a strong, reputable, and scalable marketplace.

The Emissions Trading System (ETS), established in 2005, is the most widely used global carbon market. It is based on the Kyoto Protocol. In order to meet its carbon emission target, ETS sets up a cap-and-trade system that rewards entities that reduce their emissions and penalizes those that do not. Organizations can purchase carbon credits to cover their emissions, or they can retire credits, which are sold to other entities to offset their emissions.

The voluntary carbon credit market is also becoming more popular. This market has grown significantly over the last few years, and many companies have set goals to reduce their emissions. The United Nations Development Programme is part of this multi-stakeholder initiative. It advises countries on how to develop and produce carbon credits.